If anything’s been dominating our feeds more in recent years than AI, it’s product-led growth; with good reason.

Product-led growth is no throwaway SaaS term. It’s music to any VC’s ears. And, it’s helping SaaS companies go to market quicker than those “little piggies” we were told about as a child.  In this article, we’ll explore the four product-led go-to-market (GTM) models on the table that will help your SaaS grow at a lower cost than relying on sales-led growth. We’ll close out with how you can pick the right model going on your SaaS growth goals.

In this article, we’ll explore the four product-led go-to-market (GTM) models on the table that will help your SaaS grow at a lower cost than relying on sales-led growth. We’ll close out with how you can pick the right model going on your SaaS growth goals.

Right, we’ve got a lot to get through, so let’s jump in.

There are four product-led GTM models up for grabs: trials, sandboxes, pricing, and freemium plans.

You can still have sales-assisted or marketing-assisted product-led growth.

Product-led growth puts your product and customer experience at the top of your priorities list.

Your PLG model will differ depending on your product and growth goals: monetization, retention, or acquisition.

What is a go-to-market model?

A go-to-market (GTM) model is a type of strategy that helps you better position a product for prospective customers. SaaS businesses rely on a GTM model if they’re:

Launching a new product

Launching an existing product in a new market

Trialing a market for potential growth opportunities

By thumbing down a GTM model, SaaS businesses are able to pitch products against their competitors, create successful sales journeys, identify a north star metric, and align teams on working towards higher business revenue.

What is a product-led growth GTM model?

A product-led growth GTM model (PLG model) is a way SaaS businesses launch new or existing products by prioritizing the product, not the teams around it. Meaning the product sells itself, and the people support the product selling itself.

A product-led growth GTM model often sees drastic reductions in the costs of sales teams and even customer success teams. It’s a financially secure way for SaaS companies to grow as they’re minimizing costs on human resources; in the buying process and beyond.

SaaS marketers often focus on boosting conversion on the front end, but rarely the back end. You must note that most SaaS marketers miss the fact that "the product" plays a huge role in improving the conversion metrics.

Product-led GTM models to choose from

There are four product-led GTM models to choose from. Each product-led go-to-market model comes with its own set of pros and cons and will often be prioritized: acquisition, monetization, or retention.

What your SaaS (or investors) are looking for—as well as your resources—will decide the model you’ll choose.

1. Free trial: product-led growth framework

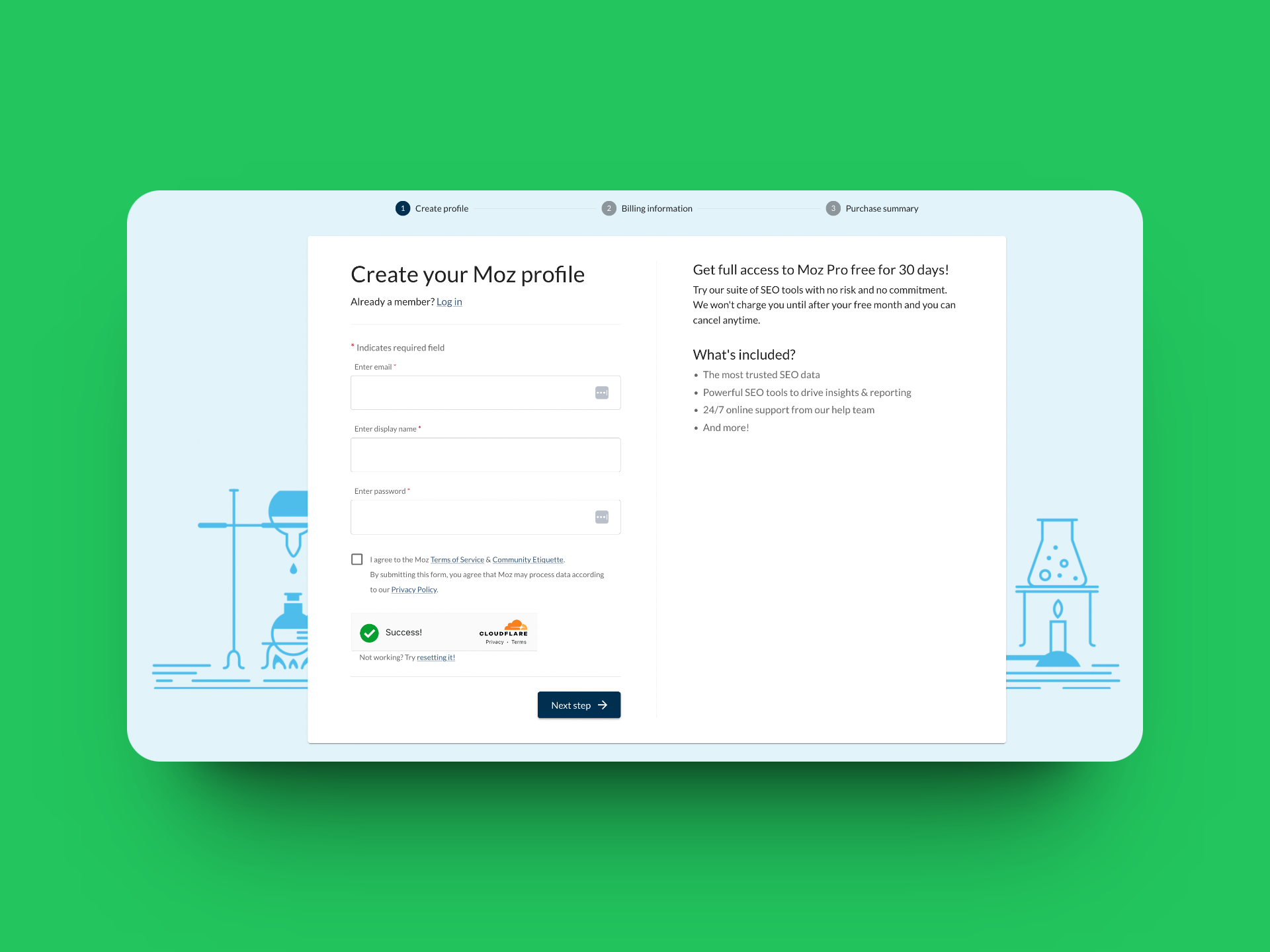

A free trial was once a fantastically popular GTM strategy and still serves many SaaS today well. For example, you’ll see ChartMogul, Levity, and Moz making the most of a free trial.

Free trials for B2C brands are typically around a week, whereas B2B SaaS companies tend to need around two weeks to a month to get their users to their aha! moments, and successfully integrate the tool as part of a tech workflow.

There are three types of free trials you need to know about.

Opt-in free trials

Simple and effective. They require a minimal lift from a user and mean someone can get their hands on your product there and then—when they’re most interested in it.

The main difference between an opt-in and opt-out free trial is that an opt-in doesn’t require a credit card, but an opt-out does—even if it isn’t charged at the time.

Opt-in free trials are fab if you’re looking to figure out a new product’s time to value (TTV). They enable you to test quickly and learn from new user data.

Opt-in free trials are fab if you’re looking to figure out a new product’s time to value (TTV). They enable you to test quickly and learn from new user data.

However, the minimal lift for new users often means you’ll get users that aren’t necessarily product-qualified. This can potentially leave your product open to abuse and negative reviews on 3rd-part review platforms. It also means you could be setting yourself up for low conversion and high churn rates: worrying numbers most VCs don’t want to see.

Opt-out free trials

Now, opt-out free trials are a whole other ball game. They require a credit card, which of course, adds a level of friction to your sign-up process, as well as requires a certain amount of trust—even if you do offer to cancel at any time. Winning an email is one thing, but a credit card is something else.

An opt-out free trial will require your team to do a heavy amount of upfront lifting before a user trusts in your brand and product enough to hand over their credit card details. Users will be doing their research beforehand.

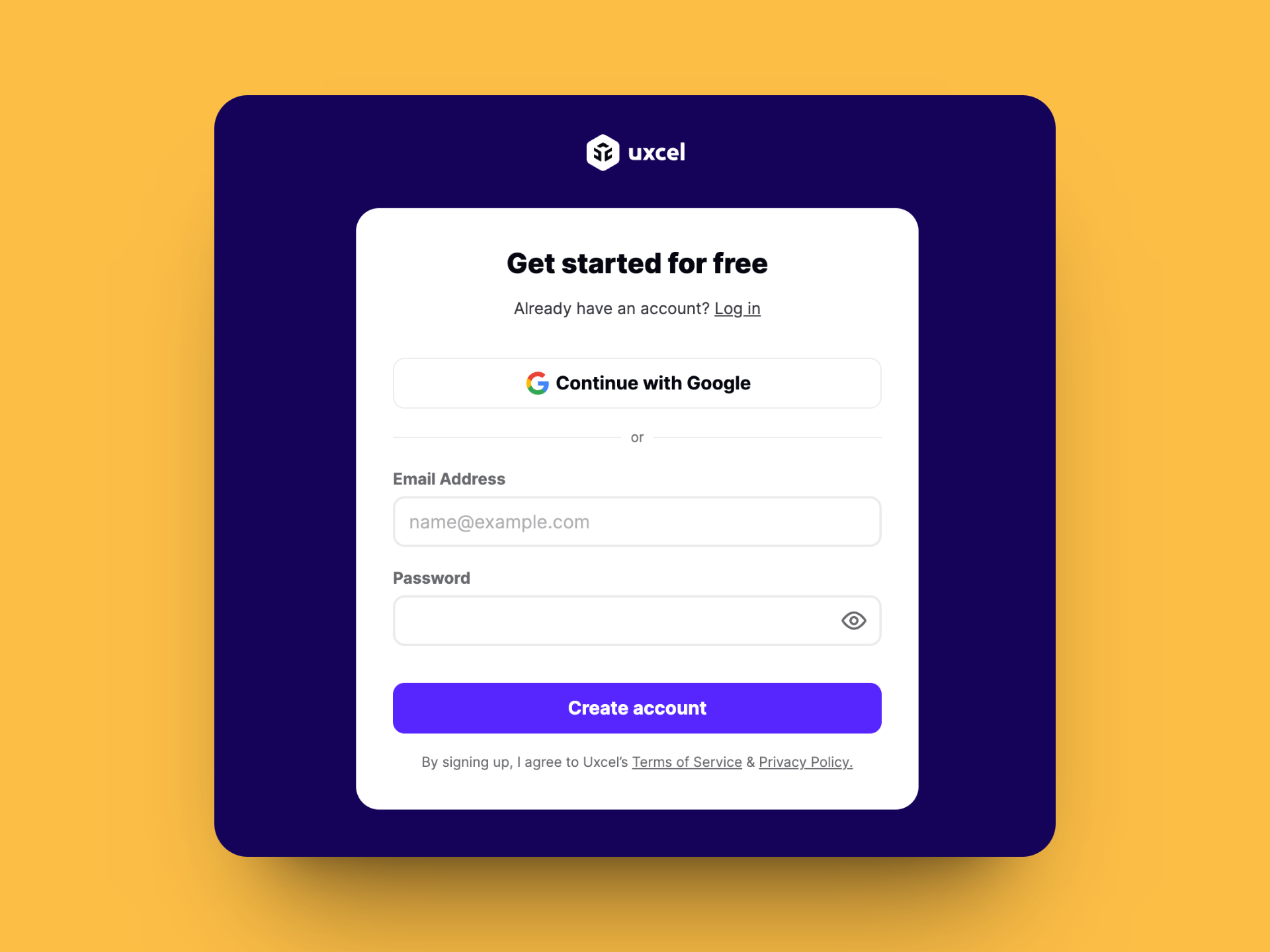

For example, Moz is in a great brand authority position to be able to use this product-led GTM model.

A few things you can expect are that users tend to be more engaged during a free trial when their card details are on the line: it makes for more active users, which will often result in a reduced TTV and higher conversion rate. In fact, Userproof found there was an average conversion rate of 25% for free trials requiring a credit card.

A few things you can expect are that users tend to be more engaged during a free trial when their card details are on the line: it makes for more active users, which will often result in a reduced TTV and higher conversion rate. In fact, Userproof found there was an average conversion rate of 25% for free trials requiring a credit card.

However, when it comes to reporting to VCs and other product stakeholders, there are a few things you’ll need to look out for. Free trials requiring credit cards could be generating false revenue, with delayed chargebacks and inaccurate MRR predictions. They have a higher barrier to entry, which means lower acquisition costs, meaning higher CACs, and often delayed churns for those that may have forgotten to cancel after their trial period is over.

You’ll need a solid support team and a stellar in-app product experience if you’re hoping to retain users after their free trial is over.

Usage-based free trials

Lastly, you’ve got usage-based free trials. Which are essentially time-stamped freemium models. In this type of free trial, a user will have limited access to your application. This model is a fab opportunity to run some fake door tests and really hone in on your features that are going to help users activate.

Although this type of free trial is great for gathering data and incentivizing people to convert at the end of the free trial period, you’ll need to play this game wisely. You’ll need to know what provides just enough value to your users to give them faith in your product, and what will convince them (despite not having access to it) to stay with you after the trial is over. It can be easy to frustrate users with this free trial model.

Are your trial users dropping off? Use Tours to clearly show what they are missing out on. Help them quickly realize how your product makes their job easier. Learn more about how personalizing in-app communication can improve your trial conversions! 📈

2. The freemium GTM model

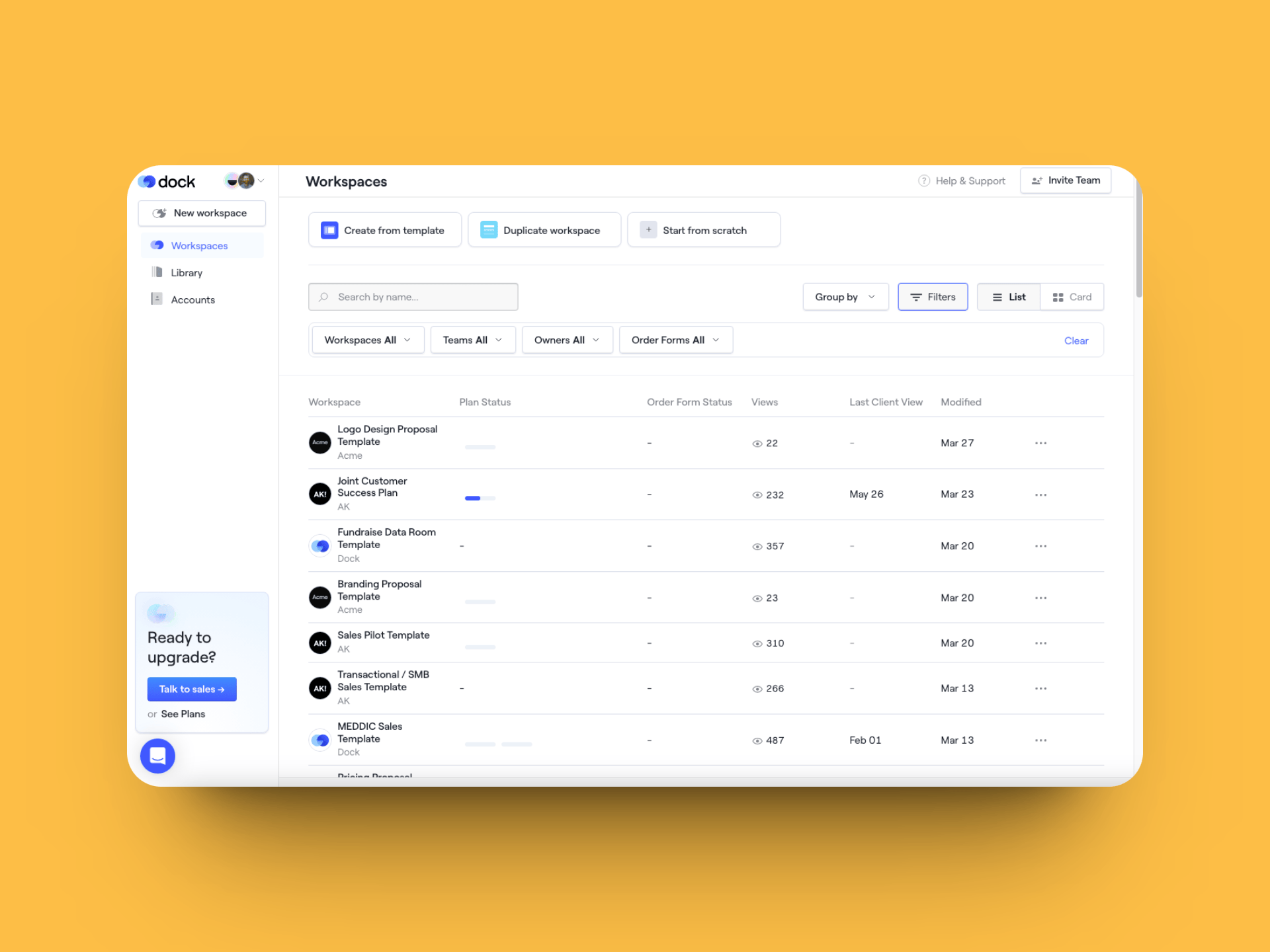

Freemium plans! These are extremely popular PLG GTM models and are used by the likes of Dock and Zoom. Freemium plans give users limited access to your product, forever! They provide the same UX as paid users yet restrict users from advanced features.

To understand the Freemium model better, we spoke to Eric Doty, Content Lead at Dock. Eric shared his experience on how and why Dock made the shift to a freemium model for a better Product-led growth framework.

At Dock, we changed from a 14-day free trial model to a freemium model. For a bit of context, Dock can be used as a sales or onboarding workspace for more complex deals. A sales rep can use Dock to host all their follow-up sales assets, pricing tables, demo recordings, etc., in one place for their buyer.

The problem with a free-trial model was that our "Aha moment" happens when our users close a deal with a Dock workspace for the first time. But:

(1) They're normally busy sales leaders who won't necessarily jump into our product within 14 days

(2) Their sales cycles typically last longer than 14 days

We realized it was better to give them infinite free time in our product and instead limit them to five free workspaces. That gives them the opportunity to close a few deals with Dock before being asked to pay. Once they see the value in their sales process, they're hooked.

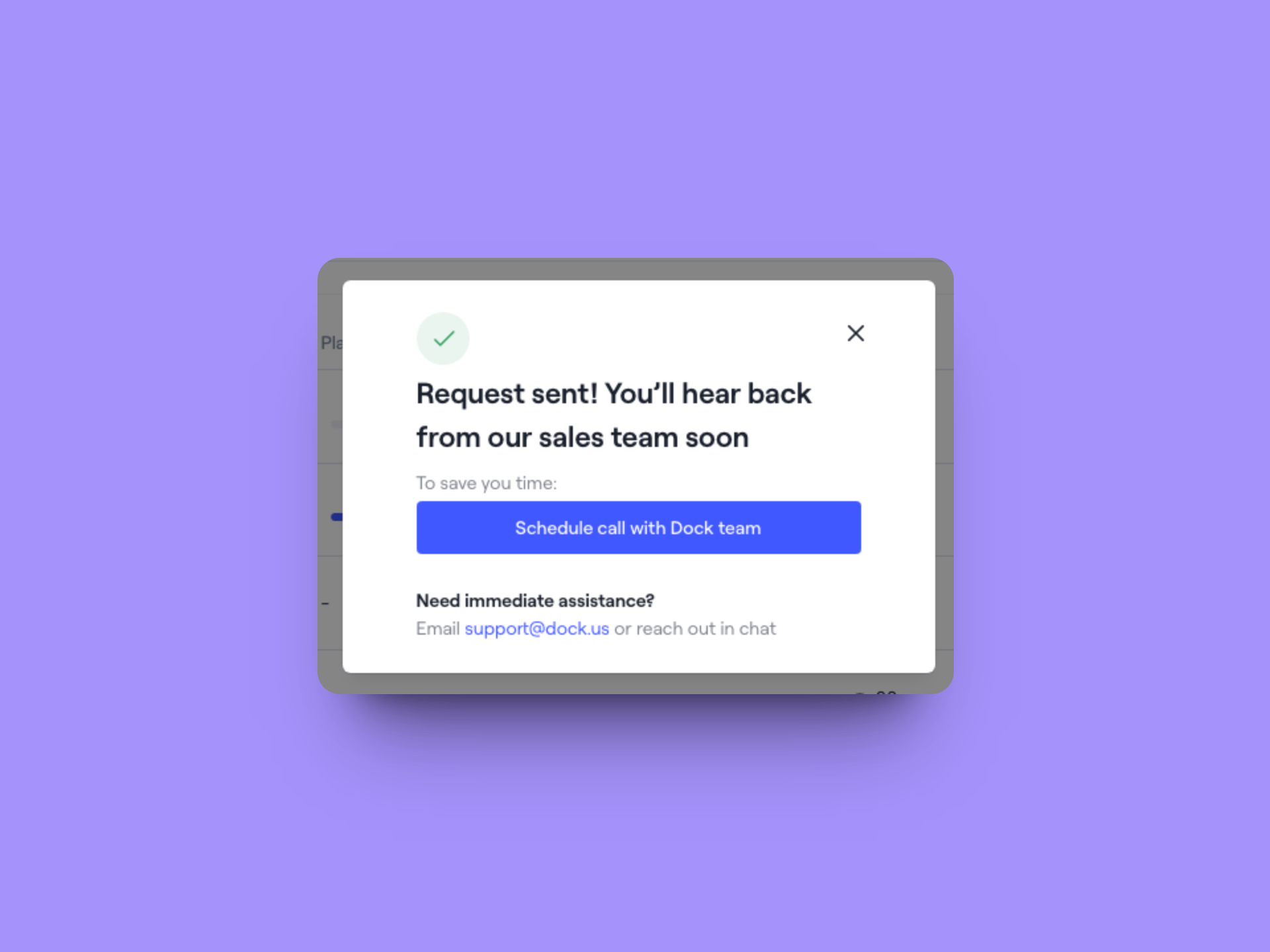

The team at Dock monitors freemium users’ activity and will reach out to extremely active users if they think there’s an up-sell opportunity there. Asides from this sales assist, the freemium users have two in-product prompts:

A general "talk to sales" prompt in the bottom-left

A prompt that comes up when someone hits their free limits

Eric highlights a few crucial pain points around free trials and some easy wins with Freemium models that will ring true for a lot of SaaS:

Eric highlights a few crucial pain points around free trials and some easy wins with Freemium models that will ring true for a lot of SaaS:

Freemium GTM models enable users to experience what your product can do at their own pace

A freemium model makes acquiring new users easy—great for acquisition, active user, and retention metrics

Product value aside, the right operational-orientated gated features will promote freemium users to upgrade as they become more successful with your product

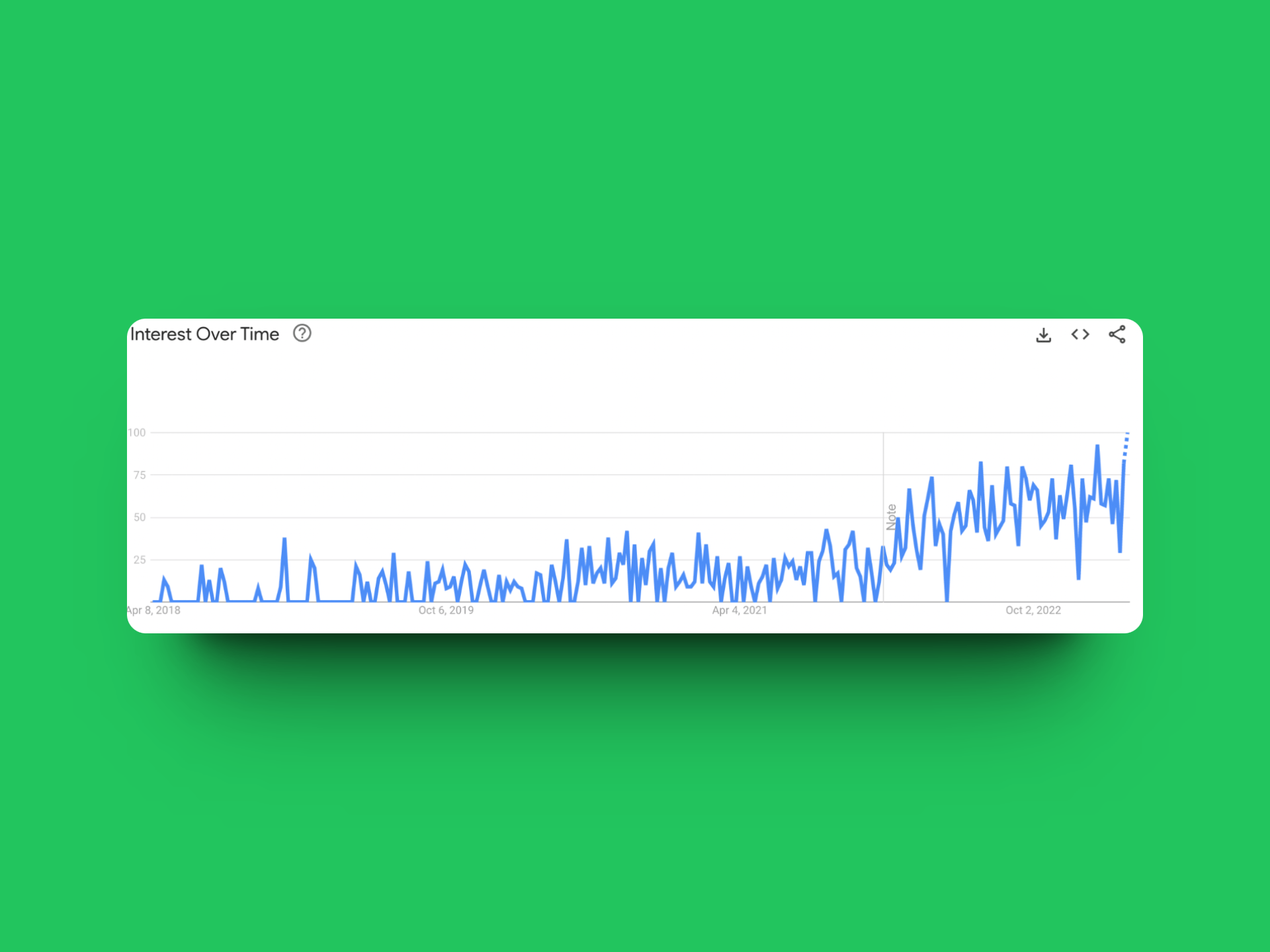

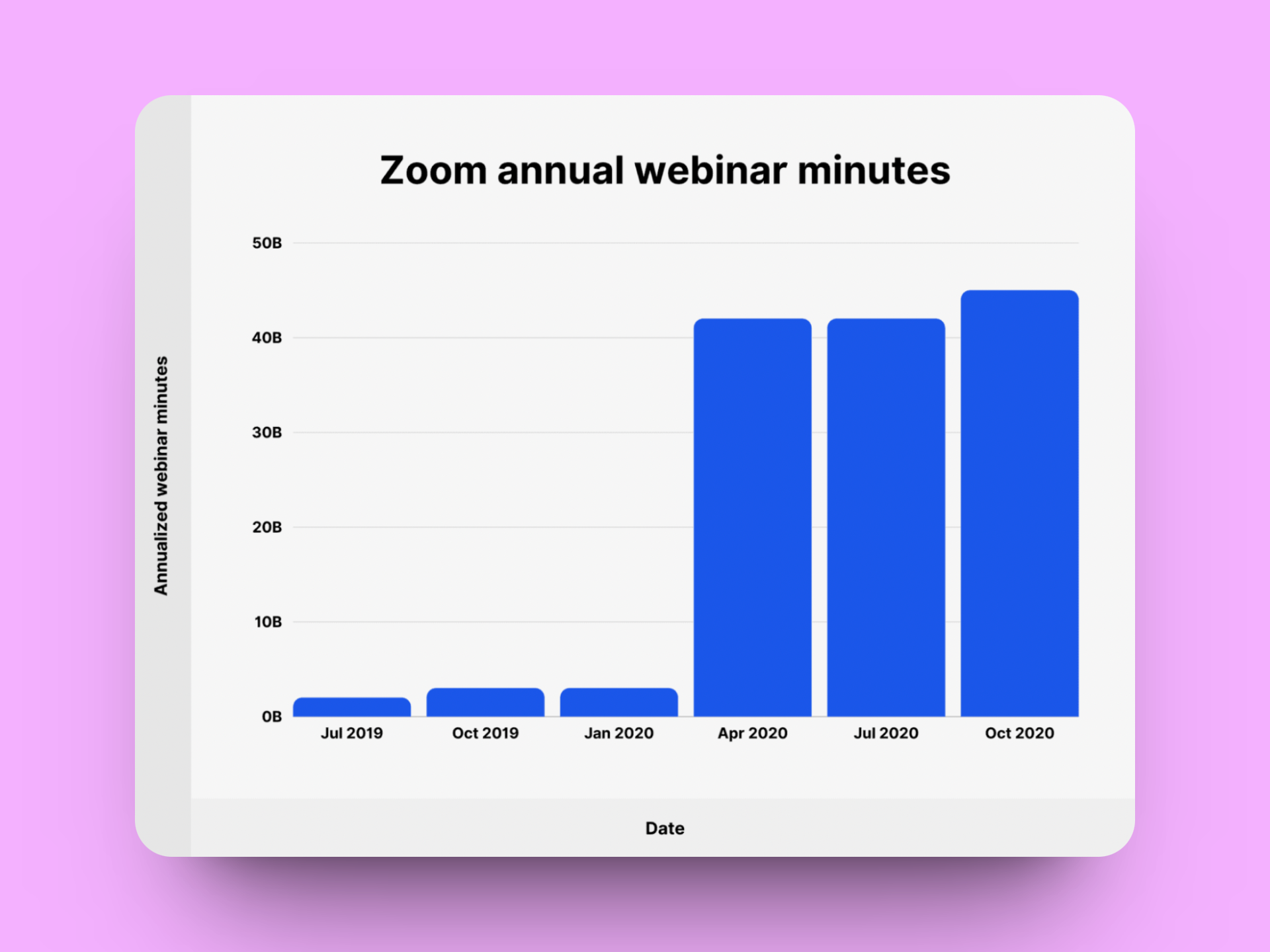

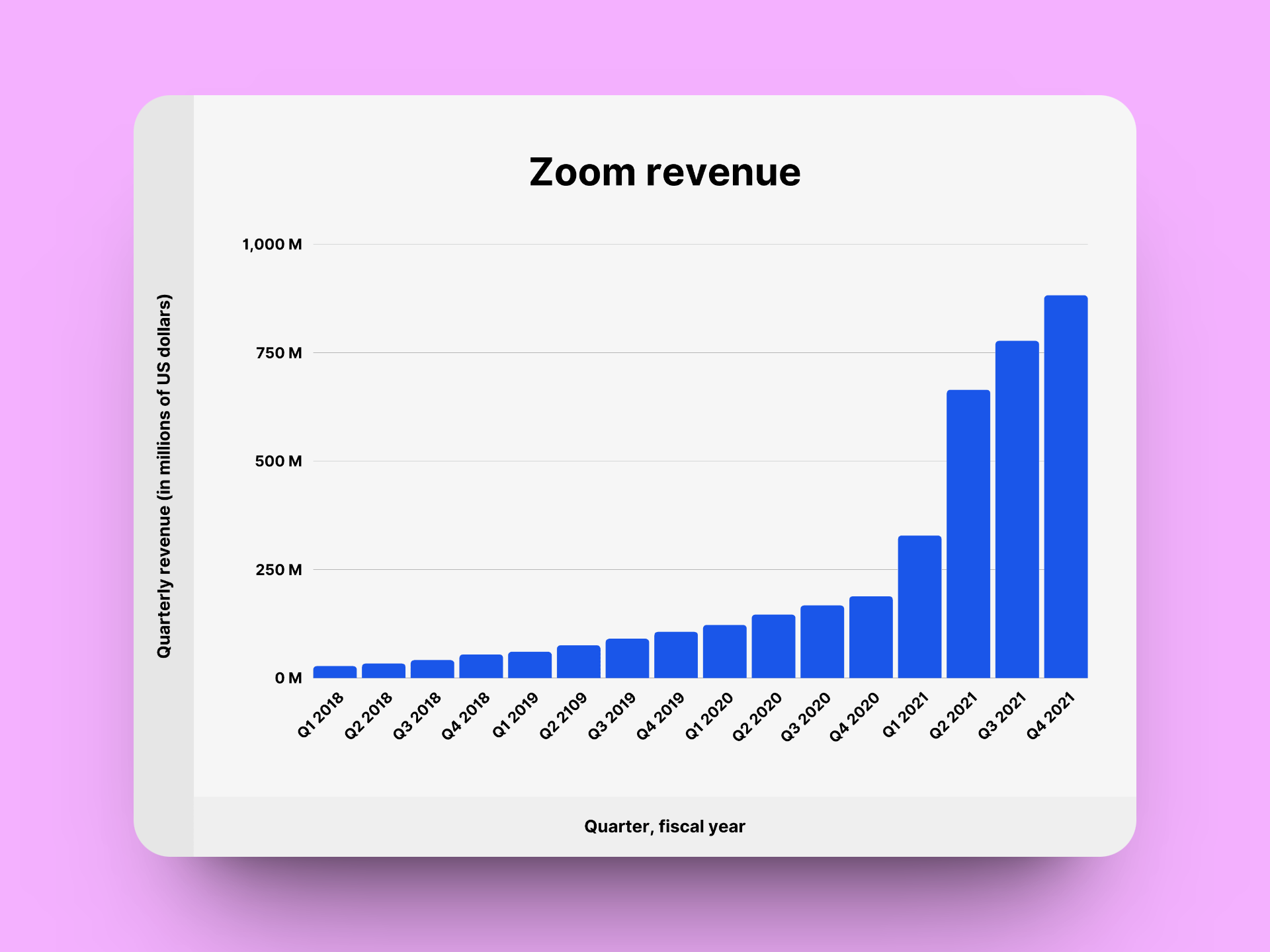

Freemium models are also fantastic for creating solid online communities. They rely on one of Cialdini’s core principles of persuasion: reciprocity. This can help you build some fiercely loyal users that will happily promote your product. Think of how Zoom saved many newly-remote teams throughout the pandemic with its freemium model. The right freemium product, in the right market, can be hugely successful.  Lay their usage growth data alongside their revenue data:

Lay their usage growth data alongside their revenue data:

Who said freemium models aren’t profitable?!

Who said freemium models aren’t profitable?!

Sure, you may not get great revenue at first. However, if you can get the ingredients right, you’ll develop a huge active user base and an engaged community, and in turn, revenue will come.

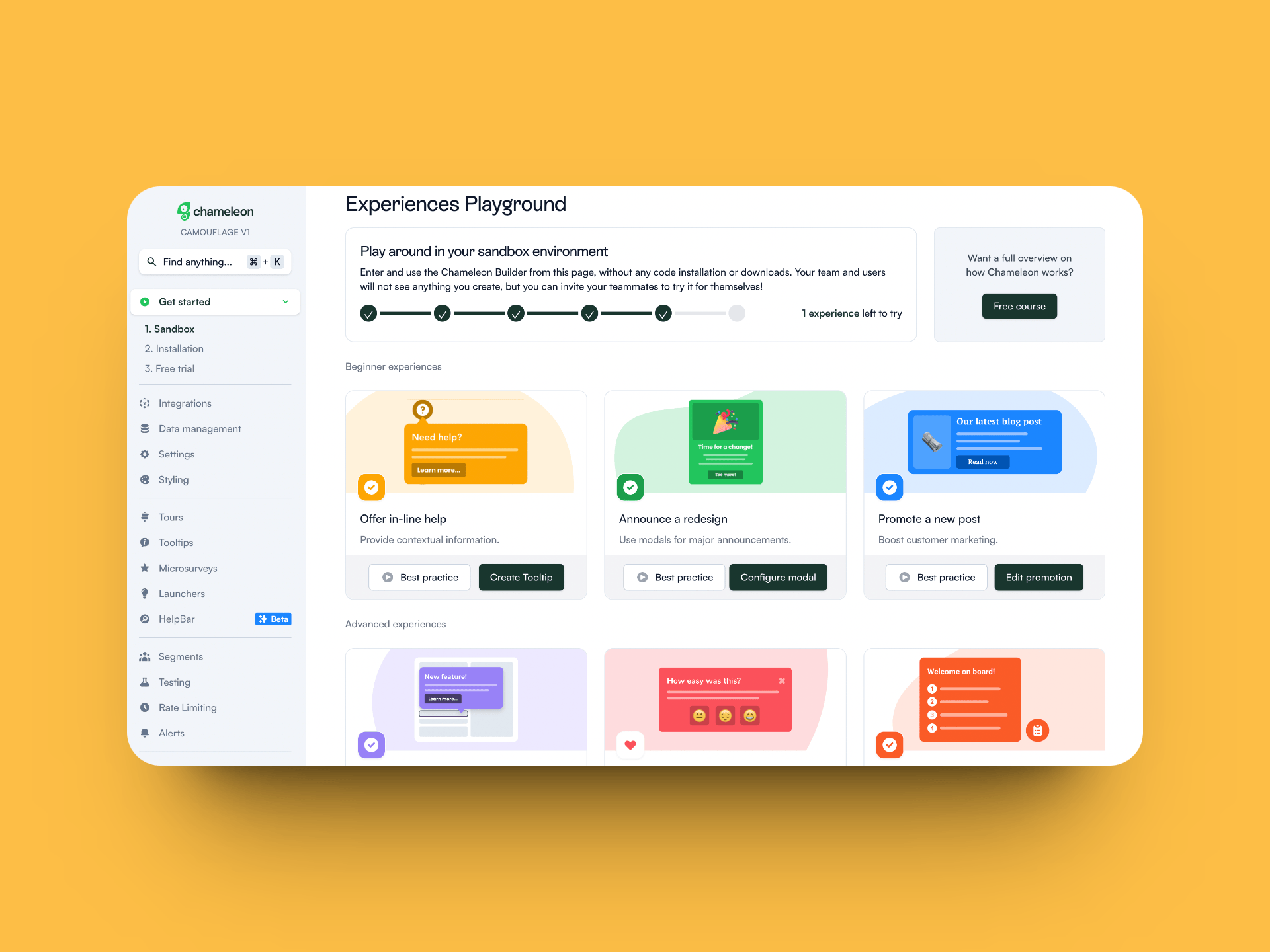

3. Sandbox environments

A sandbox environment is different from a freemium version as it’s more of an interactive demo within a mockup environment.

This product-led go-to-market model is a dream for user onboarding and building an engaged user base. Your onboarding flows and in-app messages can streamline new users’ TTV, educate them on often overlooked features, and will often result in a reduced customer acquisition cost.

The sandbox environment gives users a playspace to see if your product is for them, which means they don’t need to onboard your product with any of their business data to understand your product’s value. With a sandbox, you’re less likely to disgruntle users—low friction and high education.

Although, a sandbox environment can be tricky to personalize, and as users aren’t integrating it into their own workflow from day one, the Aha! Moments can be more: “mmhmm”. You’ll need to really blow users' socks off if you hope to convert them to paying customers.

A Sandbox environment makes sense for us at Chameleon, as Chameleon’s Co-founder, Pulkit Agrawal, explains:

For Chameleon, one of the harder aspects of getting value from the product is because it operates within a customer's application. So it requires installation and going live can be significant because something can go to your users.

Therefore, a sandbox environment where anyone can come and play with our product, without any installation, without any concern or risk about it going live to users, it’s a great way to showcase the value of the product.

It's no risk, it's really quick, and it treats everyone as an individual because, in our buying process, there are many, many advocates, and influencer stakeholders.

So this gives a chance—not just for whoever is leading the evaluation or is the main advocate—but anyone, even if they come in late to the game.

Pricing models

Last but not least, are pricing models and your pricing strategy. There are four different types of product-led GTM pricing models to consider:

Usage-based pricing

Seat-based pricing

Tier-based pricing

Modular pricing

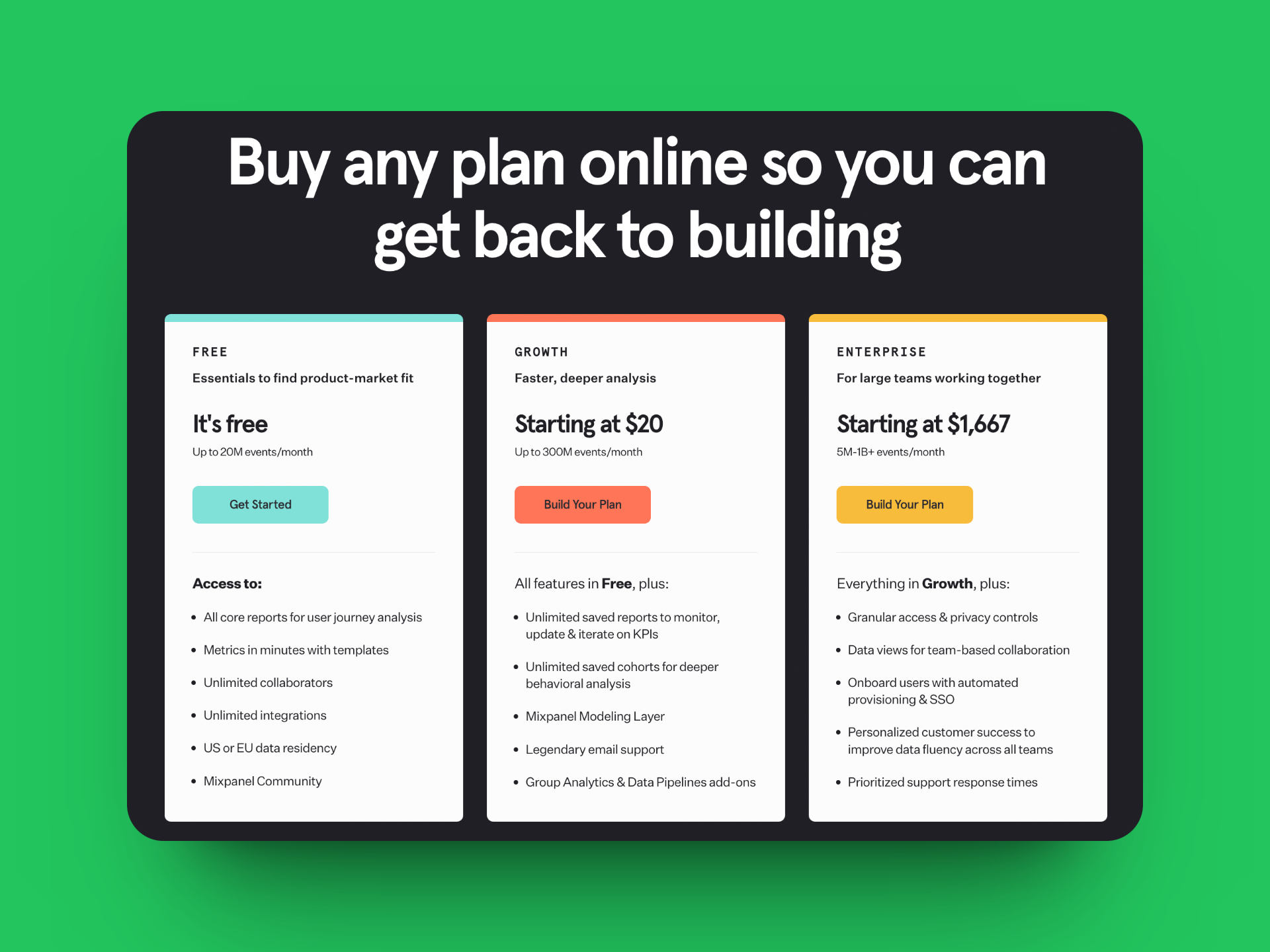

Usage-based pricing

Usage-based pricing means your pricing plan expands as people use your product more. The trick is knowing at what usage point users should shift to a higher price point. Mixpanel does this well and has hit the nail on the head.

Mixpanel has a usage-based freemium model and then continues pricing plans based on a number of events per month. What’s great for SaaS with this pricing model is usage expansion means contract expansion.

Mixpanel has a usage-based freemium model and then continues pricing plans based on a number of events per month. What’s great for SaaS with this pricing model is usage expansion means contract expansion.

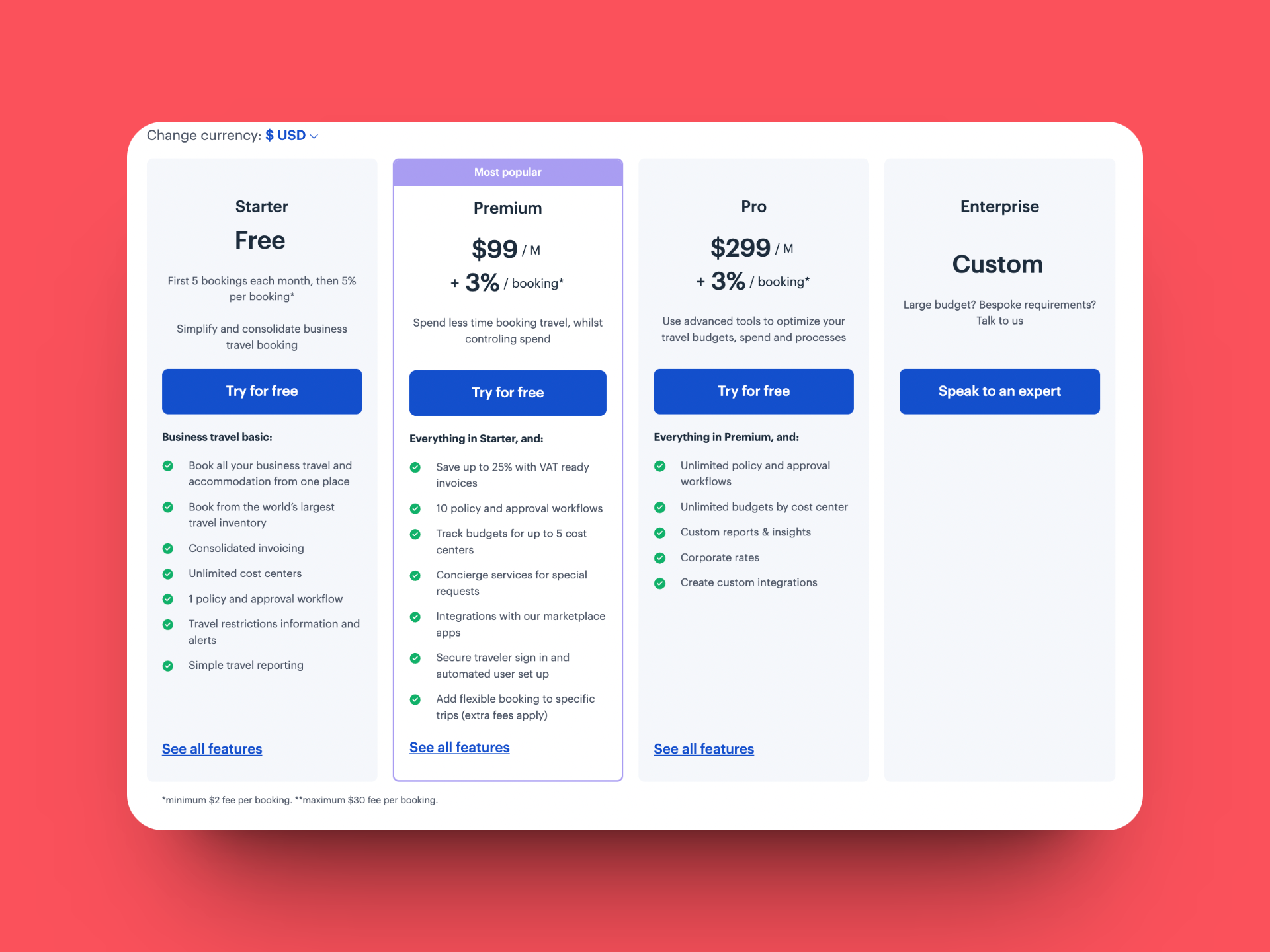

TravelPerk has built an interesting spin on the typical usage-based pricing model, they charge users a percentage of the spend they make within the app. Of course, this type of pricing strategy only works if your app enables users to spend, but it could be worth considering.

Seat-based pricing

Seat-based pricing

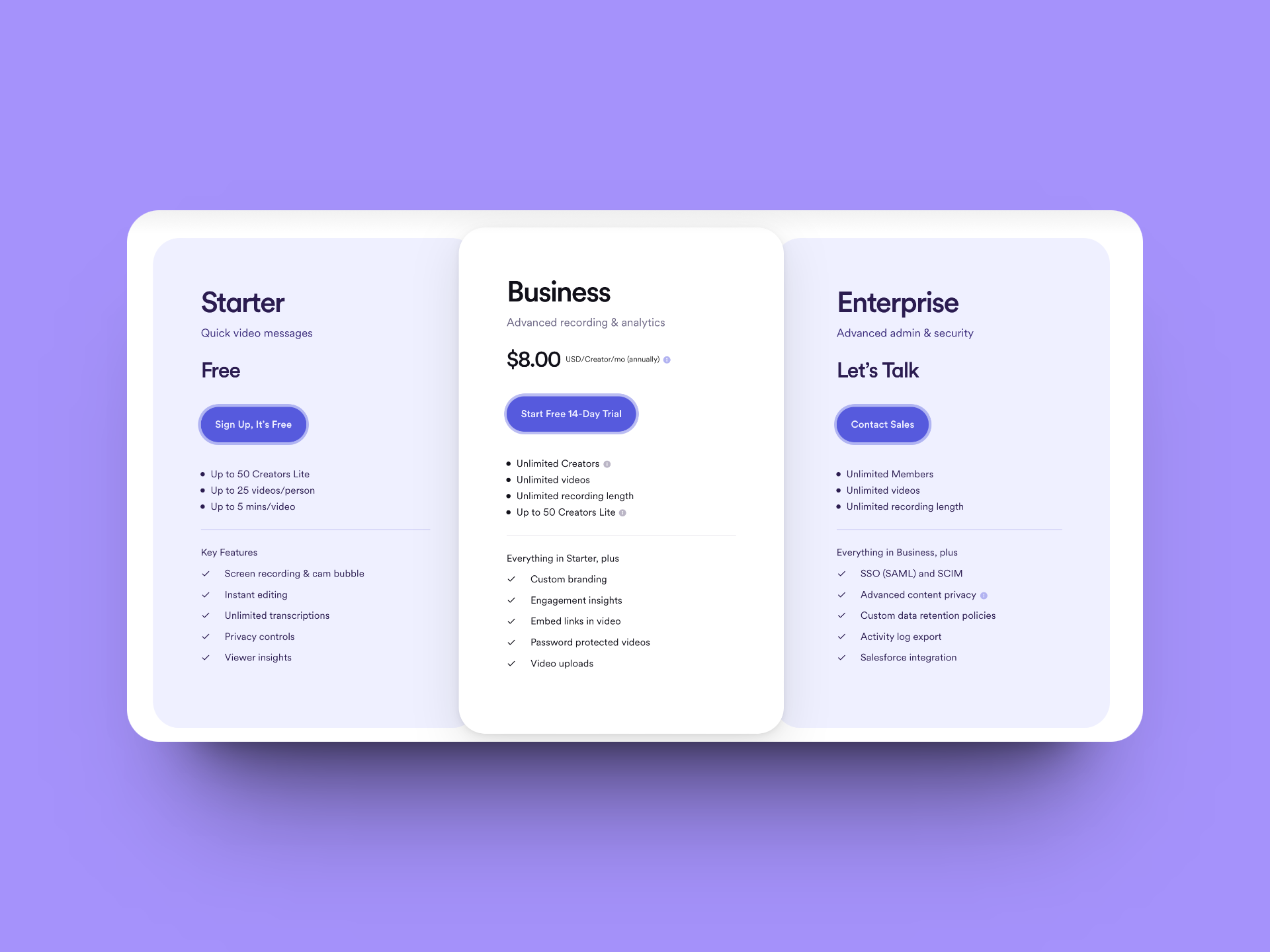

The right SaaS, with seat-based pricing, is on to a winner. The trick is getting around people using a communal email address, and seemingly using only one seat. Outside of tracking VPN, how do you do this? By providing further value in having multiple users within your SaaS. Collaboration SaaS tools (Canva, Pitch, Google Workspace) make sense for this pricing model. Or, instances where you’ll want to hide certain features or information from other users, for example, Loom.

Loom does well with this pricing strategy. It’s a seemingly low-cost investment for businesses as they’re charging by seat and monthly. Loom uses three operational restrictions to promote higher tiers:

Video length

No. of creators

No. of videos

Like Loom, many SaaS offer “unlimited guests” on accounts: who essentially access a freemium version of the app. This is a fantastic tactic for getting buy-in from other stakeholders for your SaaS. Even if they’re micro-users, the “network effect” means you’re getting your product in more hands, which will make for an easier business case for product investment.

Like Loom, many SaaS offer “unlimited guests” on accounts: who essentially access a freemium version of the app. This is a fantastic tactic for getting buy-in from other stakeholders for your SaaS. Even if they’re micro-users, the “network effect” means you’re getting your product in more hands, which will make for an easier business case for product investment.

If you’re trying to appeal to SMBs, a useful strategy for your seat-based pricing model is to introduce: active seat-based pricing. Slack does this wisely: non-active users are removed from your monthly bill. It’s a great way to increase brand trust and not turn heads toward questioning your contract.

“Paid members are only billable if they’re actively using Slack. Slack will automatically detect if members become inactive, and if that happens, we'll add prorated credits** to your Slack account. Those credits will be applied toward future payments, such as new members being added to your workspace or your next renewal date.”

— Slack’s fair billing policy.

Tier-based pricing

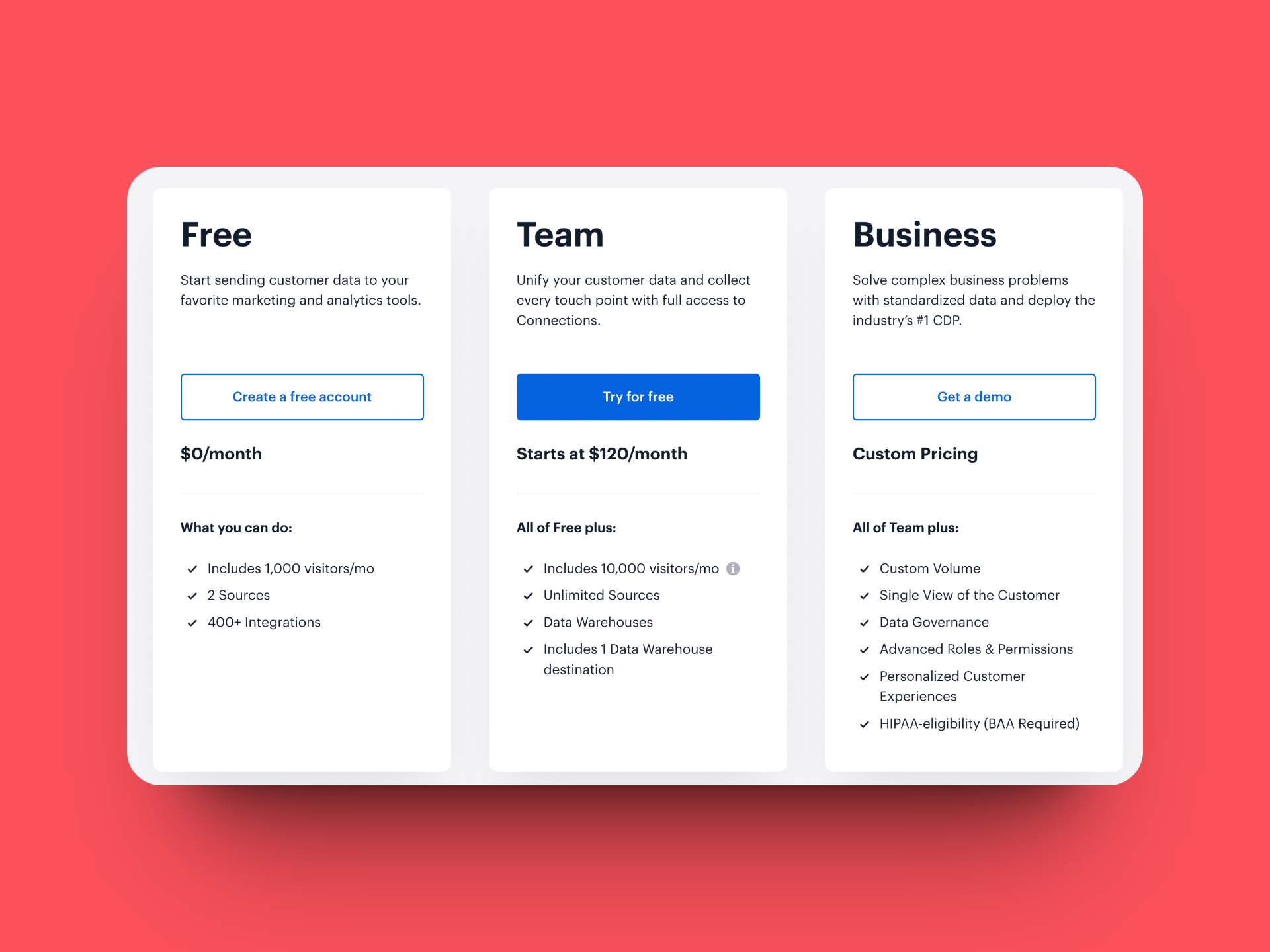

You’ve also got tier-based pricing, which is perhaps the simplest pricing model of the bunch. Let’s look at Segment as an example of this. Three plans: Free, Team, and Business. They’re straightforward, clear, and even come with a free trial.

It’s worth keeping in mind that these plans can seem a little too fixed for SaaS businesses that need more of a custom solution—having only three options may mean that none are a fit.

It’s worth keeping in mind that these plans can seem a little too fixed for SaaS businesses that need more of a custom solution—having only three options may mean that none are a fit.

However, tier-based pricing is a great way to eliminate decision fatigue and get your user into your product fast rather than pondering the best plan for them.

Modular pricing

Finally, the most complicated of the bunch is modular pricing. Modular pricing means you’ll break down your core features and upsell/cross-sell them individually, enabling users to build custom packs that are a perfect fit for their business needs. Modular pricing is great for complex SaaS that offers a range of features and products that complement each other but may not be necessary for everyone, like Salesforce or Hubspot.

Modular pricing may require a larger sales team input, to help users make a decision and figure out a solution that’s right for them. However, there’s nothing wrong with a sales-assisted GTM model.

That’s all of our PLG GTM models on the table. Now, it’s up to you to choose your PLG flavor.

How to know which PLG model is the best for you?

Hopefully, some of our PLG GTM examples from leading PLG companies above have set your own SaaS cogs into motion. However, if you still need a little more decision-making support, you need to consider your growth goals. Which are you going for?

Acquisition

Monetization

Retention

PLG acquisition

If you’re going for acquisition growth goals, then you’ll be looking to get your product into your users’ hands as quickly and seamlessly as possible. This means you’ll want to go for a GTM model with low friction, like an opt-in free trial or a freemium plan.

PLG monetization

If you’re looking for monetization growth, then knuckle down on your pricing strategy as your GTM model, or consider an opt-out free trial—just be cautious of false revenue that it may generate when reporting.

These models also mean you’ll need to rely on great product-led marketing upfront to provide product value.

PLG retention

B2B SaaS companies looking for retention goals with their product-led GTM model will want to be fine-combing product usage data for better customer satisfaction. Retention-orientated models to consider are Sandbox environments, freemium plans, and active seat-based pricing.

Time to create a PLG framework that fits your product

We’ll close out this article with some digi-food for thought. Product-led growth doesn’t need to be all-in or nothing at all. Depending on your product, perhaps full-PLG growth just isn’t a fit. That’s not to say you can’t still have a slice of the pie.

Consider semi-PLG growth—perhaps for those lower ticket plans—so your sales and support teams can focus on larger ticket contracts. Sales-assisted or marketing-assisted PLG growth is doable for most SaaS businesses, regardless of your product.

Combine product adoption, feature adoption, and other core product analytics to thumb down exactly what your users find valuable, what keeps them in your product, and what turns them away. Then, find a GTM model that highlights your best features, and fast. Lastly, don’t be afraid of a little friction along the way, just a pinch here and there.

Now? Go take a piece of that product-led GTM pie. Enjoy.

Fuel your PLG motion with Chameleon

Create in-app experiences that delight users and boost your revenue